The mortgage market in 2025 will be important for buyers and homeowners in the United States. Many people are asking about interest rates, housing affordability, and refinancing options. This guide answers the top questions Americans have about mortgages in 2025. Whether you’re looking to buy your first home, refinance your mortgage, or just want to understand the market, you’ll find the answers you need in this article.

What Will Mortgage Rates Look Like in 2025?

Will mortgage rates go down in 2025?

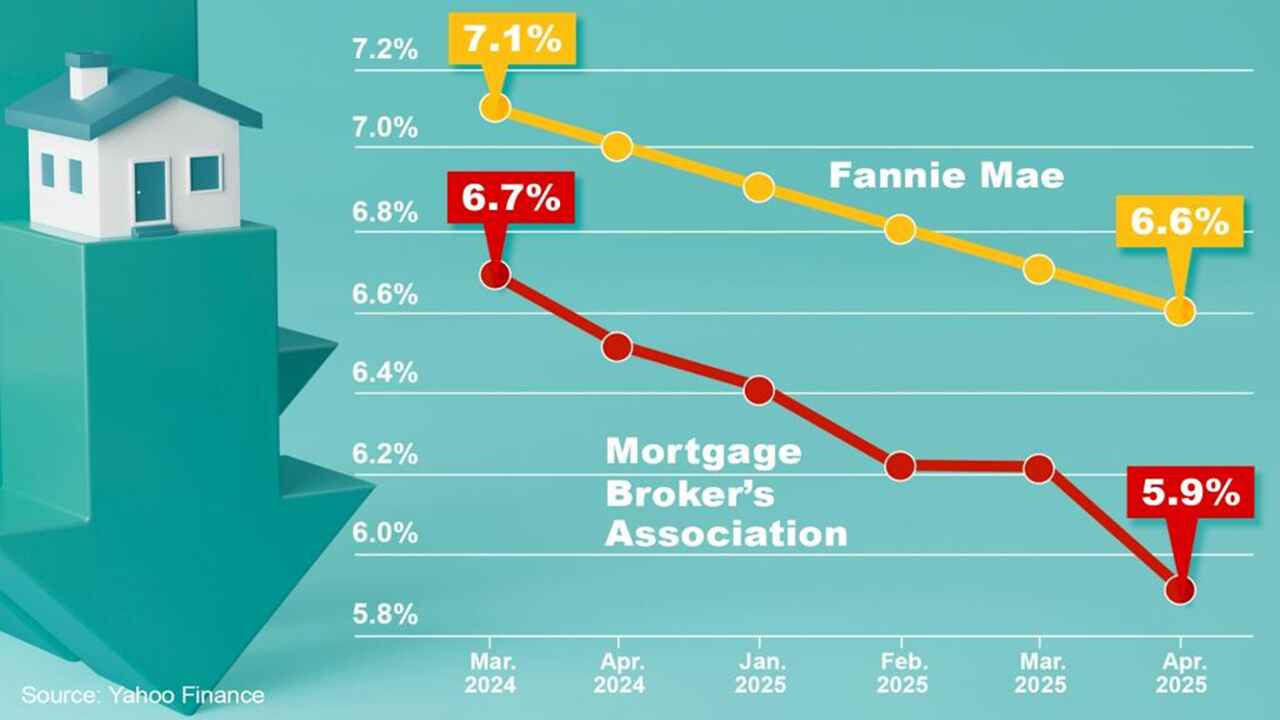

Most experts predict that mortgage rates will remain relatively stable, fluctuating between 6% and 7% for most of the year. According to the Mortgage Bankers Association (MBA), inflation concerns and Federal Reserve policies are likely to keep rates in this range. While we may see a slight rate cut in the second half of the year, a significant rate cut seems unlikely.

How will these rates affect homebuyers?

Higher mortgage rates directly increase monthly payments and make it harder to buy a home. For example, on a $300,000 loan, an interest rate of 6.5% would result in a monthly payment of about $1,896. By comparison, if the rate is 5%, the payment drops to $1,610. This means that even small changes in interest rates can significantly affect your budget.

“Buying a home is a big step, and a mortgage is like a key to opening that door. It’s not just a loan; it’s an investment in your future.”

John D., Real Estate Agent

Is 2025 a Good Year to Buy a Home?

What’s the housing market forecast for 2025?

Economists forecast modest growth in home prices, rising between 2% and 4% across the country. With this decrease in value, we will see a more balanced market than in previous years. In addition, due to the increase in housing inventory that has enlarged this market with new construction, it has given buyers more choice.

Should you wait or buy now?

Waiting may give you more options due to increased inventory, but consider how rising home prices and fixed mortgage rates can affect affordability. If you are financially prepared, buying earlier in the year can guarantee a lower price.

What Refinancing Opportunities Exist in 2025?

Is refinancing worth it at current rates?

Refinancing in 2025 may not be the best option unless your current mortgage rate is much higher than the rates offered. For example, if you have a 7.5% rate and it goes back to 6.5%, you could save about $2,000 a year on a $300,000 loan. However, if your current rate is closer to 6.5%, refinancing may not save enough to cover costs such as closing costs. Remember to calculate your break-even point and consider how long you plan to stay in your home before making a decision.

What alternatives are available?

If you need money for things like home repairs or paying big bills, you can borrow money based on the value of your home. This is called a mortgage or cash-out. You will be paid cash, but because the interest rate is higher, make sure the fees are more than worth it and won’t cause you financial problems later.

Your most important questions about mortgages in 2025

- How will inflation impact my mortgage? Inflation affects mortgage rates because it guides the Federal Reserve’s interest rate decisions. If inflation remains high, the Fed may keep rates elevated to control it. High rates make borrowing more expensive. If inflation moderates, rates might stabilize. This provides buyers with better predictability and helps in budget planning.

- Are there new programs for first-time homebuyers in 2025? Yes, there are still programs to help first-time homebuyers in the United States. Federal and state governments offer resources like down payment assistance, tax credits, and lower-interest loans. For example, some states offer assistance that can cover part of your down payment, while others reduce mortgage insurance premiums. To find out what’s available in your area, contact your local housing authority or a trusted lender.

- Can I negotiate better mortgage terms in 2025? Absolutely. Shopping around is one of the best ways to get a good deal on a mortgage. Different lenders offer different rates and terms, so compare options before committing. You can also work with a mortgage broker who has access to multiple lenders and can negotiate better terms on your behalf. Additionally, improving your credit score and saving for a larger down payment can give you more bargaining power.

- What are the risks of an adjustable-rate mortgage (ARM) in 2025? An adjustable-rate mortgage (ARM) can be attractive because it starts with a lower interest rate compared to fixed-rate mortgages. However, after the initial fixed period (usually 5, 7, or 10 years), the rate can adjust annually based on market conditions. If rates go up, your monthly payment could increase significantly. In 2025, with rates expected to stay stable or rise slightly, an ARM might be risky unless you plan to sell your home or refinance before the rate adjusts.

Tips for Navigating the Mortgage Market in 2025

- Boost Your Credit Score A higher credit score can significantly lower your interest rate. Aim for a score of 740 or above to qualify for the best terms.

- Save for a Larger Down Payment Putting down more than the minimum can reduce your loan-to-value (LTV) ratio, helping you secure better rates and avoid private mortgage insurance (PMI).

- Lock in Rates Strategically If rates drop temporarily, act quickly to lock in a lower rate. Stay in close contact with your lender to monitor rate movements.

- Work with an Experienced Real Estate Agent A knowledgeable agent can help you navigate local market conditions and identify properties that align with your financial goals.

Conclusion

The 2025 mortgage market presents both opportunities and challenges. With rates stabilizing between 6% and 7% and housing inventory growing, strategic decisions are essential. First-time buyers should consider government programs like down payment assistance, while current homeowners should carefully evaluate the benefits of refinancing.

Focus on building strong credit, saving for a larger down payment, and locking in favorable rates when possible. By being informed and planning wisely, you can make the most of the market and achieve your homeownership goals in 2025.